Dear Subscriber

The Royal Canadian Mint and US Mint are still on allocation and delivery times have lengthened further. Silver supply is the worst hit but Gold Maples are also on allocation. The message accross the industry is "Be advised that dates are extended, premiums higher and some items temporarily suspended". Some suppliers expect shortages to last into February 2016.

We have increased both sale and buyback premiums for silver Maple Leaf coins by 40 cents and will now purchase these coins from your for 1.40 USD above spot. We have not raised premiums on bars and tend to have a lower silver bar premiums on volume orders than most US based bullion dealers.

These physical shortages are ultimately due to the curious relationship between physical silver demand and silver prices, the latter being determined by highly leveraged paper positions which are not affected much by physical demand.

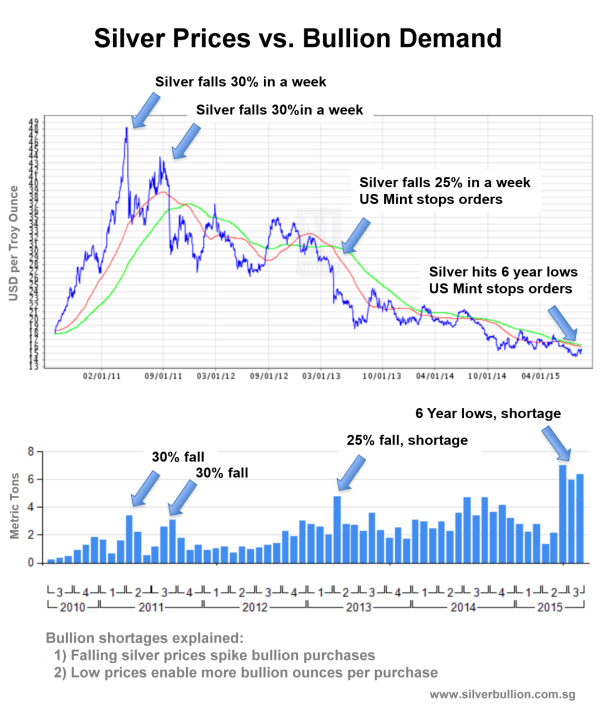

To illustrate this I am sharing with you our company order chart (in tonnes per month) over the last five years vs. the price of silver. The graphs show two clear trends that help to explain why the market has recurring silver shortages and falling prices. Details are at a later section below.

Secured Bullion P2P Lending Improvements

We greatly reduced the time it can take to obtain P2P funds by supporting four Loan Start dates per month instead of two.

Starting in September, loans will start every 1st 8th, 15th and 22nd of the month, and you will also be able to immediately lock-in bullion orders after a P2P Loan is created with a lender, regardless of the loan pay-out date.

The changes greatly increase loan timeliness and flexibility, especially if you want to purchase bullion. For storage customers the loan acceptance process is fully automated and takes only a minute, allowing you to lock-in more bullion easily whenever you wish.

| Physical Silver Demand vs. Prices |

|

A cursory look at a five year silver price chart reveals wild price swings accentuated by steep and sudden 25% to 30% price drops.

These sudden price drops often begin early on Monday morning Asian time, while US and European exchanges are still closed for the week-end, when trading volumes are low and prices can be more easily moved.

Typically there are no credible news that can explain the selloff, just the sudden paper shorts which utilize 1000% leverage (10 to 1) to sell "borrowed non-existent bullion" (a future short) to quickly push price lower. There is no physical silver sold, these are just leveraged paper positions.

By the time European and, later US markets open, silver would already have fallen considerably and many long positions holders (often small individual investors betting big on higher prices) will be panic selling, stop-loss orders would be triggered, margin calls issued and positions would be automatically sold due to the rapid price fall.

This selling will further fuel the paper sell-off and cause prices to fall further in a vicious cycle which, ultimately, generate huge profits for the short position holders.

These sudden 25% to 30% drops have occurred 3 times over the last five years and have brought prices to 6 year lows despite declining physical stocks and raising demand.

Whether these price falls represent illicit manipulations or not are legal matters that are fought out in the courts of various jurisdictions (see Banks Face U.S. Manipulation Probe Over Metals Pricing) but the fact remains that Silver Prices crashed despite healthy physical demand that exceeded new supplies.

We see this phenomenon because we sell bullion on a day to day basis. The graph below, for example, shows the 5 year silver price in relation to our physical silver bullion orders, expressed as metric tons of silver bullion ordered per month (one ton is 32,150 troy ounces).

Given our international customer base and volume, we believe that these orders are a useful proxy for overall silver bullion demand.

Notice that:

- Physical demand spikes when prices fall but physical demand seldom affects prices themselves as physical trades represents only a tiny proportion of the highly leveraged future exchanges.

- As prices fall buyers receive more bullion per dollar, causing physical supplies to fall faster.

Today, a buyer receives nearly twice as much silver per dollar spent compared to the last large shortage in April 2013 when prices were in the mid twenties, hence physical ounce deliveries are reaching new highs and we see shortages across the industry.

The current shortages are caused by a mint/refinery bottleneck rather than a raw silver shortage, however, as current silver deficits continue we will see raw silver shortages developing.

Above ground known supplies are estimated to be only 40,000 metric tons by Thomson Reuters and the silver deficit this year will be around 57.7 Million ounces - representing an expected 4% decline in reserves.

With silver prices at six year lows and dwindling physical supplies the paper markets are giving us a chance to own an increasingly rare commodity at cheaper and cheaper prices.

The current trends cannot persist. We will either see price increases soon or have much worse shortages accross the industry. Either way, silver is a great value at these prices and is selling out fast.

|

| P2P Lending Improvements |

|

Effective immediately you no longer need to worry about payout timings if you want to use a loan to buy bullion, and cash loan payouts are nearly every week, greatly improving timeliness. We also removed minimum fees.

Here are the details:

- Get Funds Faster Starting in September Loans will start every 1st, 8th, 15th and 22nd of the month. We added the 8th and 22nd Loan Starts to allow borrowers to obtain funds in, typically, less than a week.

- Immediate Bullion Lock-in You can now pay for bullion orders with your upcoming P2P funds, even if the next loan payout is more than two business days away.

- Removal of Minimum Loan Fees We removed minimum charges on each contract so that small and short term contracts are not penalized.

Read how, as a storage customer, you can obtain a Peer to Peer loan in under a minute from fellow storage customers without losing ownership of your bullion, while keeping it at TSH and without involving financial institutions. |

Our fully owned storage facility in Singapore, The Safe House (TSH), now stores 90 tons of investment grade silver or about 0.2% of known above ground silver reserves. The image shows one of the 4 storage lines.

|

|