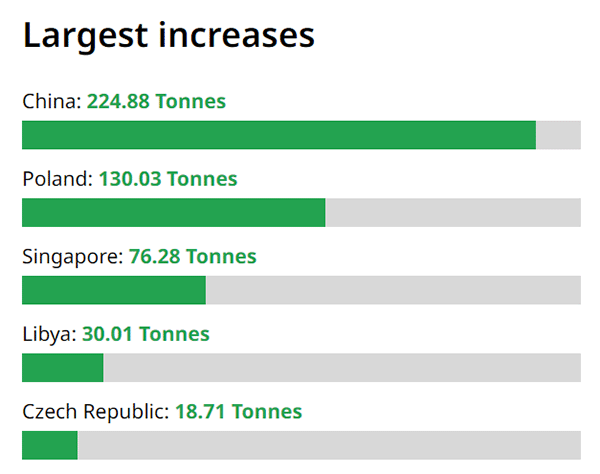

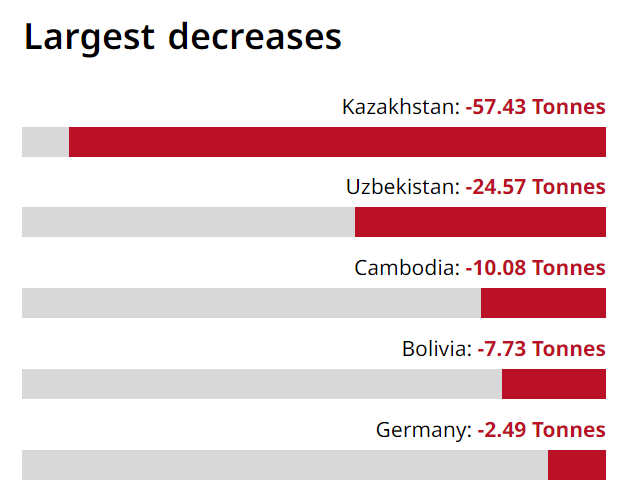

Top 5 Countries That Were Net Buyers of Gold in 2023

In 2022, global central banks set a historic record with their largest annual gold acquisition, amassing an impressive 1,083 metric tons of the precious yellow metal. This gold buying spree by central banks persisted into 2023, as countries collectively tallied up to 1,037 metric tons in annual net gold purchases, continuing the robust trend in central bank investments in gold.

2023 was also the year where the gold price rose above the milestone of $2,000 per ounce level for a record 6 times on a monthly basis, setting a new all-time high record price of $2,143 per ounce in December 2023.

In a year where prices were trending higher in tandem with gold demand, we summarize central bank gold purchases and the top 5 countries that were net buyers of gold in 2023, with data from the World Gold Council.

Why Central Banks Buy Gold

Central banks purchase gold for several strategic reasons, primarily to diversify their reserves and reduce their reliance on fiat currencies. Gold has historically been viewed as a safe-haven asset, offering a hedge against inflation and currency devaluation.

In times of economic uncertainty or when inflation rates rise, the value of fiat currencies can decline, eroding the purchasing power of a country's reserves. On the other hand, gold maintains its value over time, providing stability and security to central banks' reserves.

By holding gold, central banks can protect their national economies against the volatility of the foreign exchange markets and the inherent risks of holding assets denominated in foreign currencies.

Moreover, gold serves as a tool for central banks to bolster confidence in their country's financial health and monetary policy. Substantial gold reserves are often perceived as a sign of economic strength and a prudent reserves management strategy, which can enhance investor confidence domestically and internationally. This perception can be particularly important in times of geopolitical tensions or economic crises, where confidence in a nation's currency and economy might be wavering.

A nation’s official gold holdings act as a financial insurance policy, reassuring investors and the public of the central bank's ability to support its currency and manage its financial obligations.

Top 5 Net Buyers of Gold in 2023

When a country is described as a "net buyer" of gold, it means that, within a specific timeframe, the country's total acquisitions of gold exceed its sales of the metal, resulting in a positive net purchase. This contrasts with merely being a "buyer of gold," which indicates that the country is purchasing gold but doesn't account for its sales. Being a net buyer implies a strategic increase in gold reserves, reflecting a country's intention to bolster its financial security, hedge against economic volatility, or diversify its investment portfolio.

Which Country Bought the Most Gold in 2023?

#1 China (224.88 metric tons)

China was the second-largest buyer of gold in 2022 (62.21 metric tons). In 2023, it was the largest buyer of gold. The People's Bank of China was the most consistent gold buyer, having bought gold in all quarters of 2023 – 57.85 MT in Q1, 45.10 MT in Q2, 78.07 MT in Q3, and 43.86 MT in Q4. Despite being the largest buyer of gold this year, China's gold reserves only represent 4.33% of its foreign reserves.

#2 Poland (130.03 metric tons)

Poland climbed 7 places to having the 15th largest gold reserves in the world, having net purchases of 130.03 metric tons of gold in 2023. Apart from Q1, the Eastern European nation's central bank, the National Bank of Poland, bought gold in every quarter in 2023 – 48.41 MT in Q2, 56.63 MT in Q3, and 24.98 MT in Q4.

#3 Singapore (76.28 metric tons)

Singapore, where Silver Bullion is based, was surprisingly the 3rd largest net buyer of gold in 2023. The city-state last increased its gold reserves in 2020. Having bought 76.28 metric tons of gold in 2023, Singapore ended the year with the 23rd largest gold reserves in the world.

#4 Libya (30.01 metric tons)

Following its purchase of 30.01 metric tons of gold in 2023, Libya now has the 4th largest gold reserves among countries in the Middle East & North Africa. All of Libya’s gold purchases were made in the fourth quarter of 2023.

#5 Czech Republic (18.71 metric tons)

Like Libya, the Czech Republic bought all its gold in the fourth quarter of 2023. The 18.71 metric ton increase of gold represented a massive 156% increase in the country’s gold reserves.

Source: World Gold Council data

Other Countries That Bought Gold in 2023

Below are other countries that bought a notable amount of gold in 2023. The figures do not account for gold sales by the country within the year.

#1 Turkey (130.64 metric tons)

With 130.64 metric tons of gold purchased in 2023, Turkey would have been the second-largest net buyer of gold had it not sold 132.23 MT of gold in the second quarter. With the sale, Turkey was a net seller of gold, decreasing its gold reserves by 1.58 MT in 2023.

#2 India (16.22 metric tons)

According to World Gold Council data, India, one of the fastest-growing emerging markets, was a net gold buyer, adding 16.22 MT of gold in 2023.

#3 Iraq (8.12 metric tons)

Iraq was the 5th largest gold buyer in the third quarter, with 5.69 MT purchased. It has the 5th largest gold reserves among countries in the Middle East & North Africa.

#4 Uzbekistan (6.53 metric tons)

Uzbekistan bought 6.53 MT of gold in the third quarter of 2023 but was a net gold seller for the year, reducing its gold reserves by 24.57 metric tons.

#5 Jordan (6.42 metric tons)

Although Jordan was the 4th largest gold buyer in the second quarter with 6.42 MT purchased, the Middle Eastern country ended the year with a net 2.36 MT purchased, having also sold gold within the year.

Top 5 Net Sellers of Gold in 2023

While the spotlight often shines on the countries amassing gold reserves, an equally compelling narrative unfolds on the other side of the spectrum. In 2023, amidst fluctuating economic landscapes and strategic financial realignments, certain nations took a different path, emerging as the top net sellers of gold. Below are the top 5 net sellers of gold in 2023, according to World Gold Council data.

#1 Kazakhstan (-57.43 metric tons)

#2 Uzbekistan (-24.57 metric tons)

#3 Cambodia (-10.08 metric tons)

#4 Bolivia (-7.73 metric tons)

#5 Germany (-2.49 metric tons)

Source: World Gold Council data

Singapore is the 3rd Largest Gold Buying Nation in 2023

The Monetary Authority of Singapore (MAS) increased Singapore's gold reserves by 76.28 metric tons, representing a massive 49.6% increase in its total gold holdings. Singapore also bought more gold than any other nation in the first quarter of 2023. This underscores the city state's determination to diversify a greater portion of its total reserves into one of the safest assets in the world.

Mr Shaokai Fan, WGC’s head of Asia-Pacific excluding China and its global head of central banks, summarized Singapore's bold move in the gold market in an interview, saying, "For Singaporeans, it means that their currency and economy have even more layers of protection against an uncertain world."

Free from counterparty risks, gold acts as a trusted asset in any country and across all economic conditions, positioning it as a global key reserve asset, on par with government bonds. Gold's solidity is also the reason why it is the safest asset in the Exter's Pyramid.

Singapore buying gold will only greatly improve its financial standing in the world, given that Singapore has no net debt, receives the highest credit ratings, and is one of the safest countries in the world. This is why Singapore is Silver Bullion's exclusive choice for its base of operations, especially for the vault storage of precious metals.

Further reading:

- Top 10 Countries With the Highest Gold Reserves (2022)